How To Repay A Merchant Cash Advance?

Once you’ve agreed to an MCA, the repayment phase kicks off with ease, primarily orchestrated by your MCA provider. They take the reins in setting up automatic deductions from your daily or weekly sales, aligning with the terms laid out in your MCA agreement. This system is designed to run smoothly in the background, allowing you to concentrate on your business operations.

The Setup Phase: Your Involvement

Typically, the MCA provider handles the setup of automatic repayments without needing any input from you or your business. Some MCA providers may ask for written permission from you to show your merchant processor that the proposed MCA repayment automatic deductions are authorized.

Automatic Deductions: Hassle-Free Repayments

With the setup complete, your MCA repayments become a part of your business’s routine transactions. A portion of your sales is automatically directed towards repaying the advance, making the process effortless on your end.

What Are the Repayment Options for an MCA?

The MCA provider has three main ways they can deduct repayments from your business to pay back the MCA. The three repayment options are:

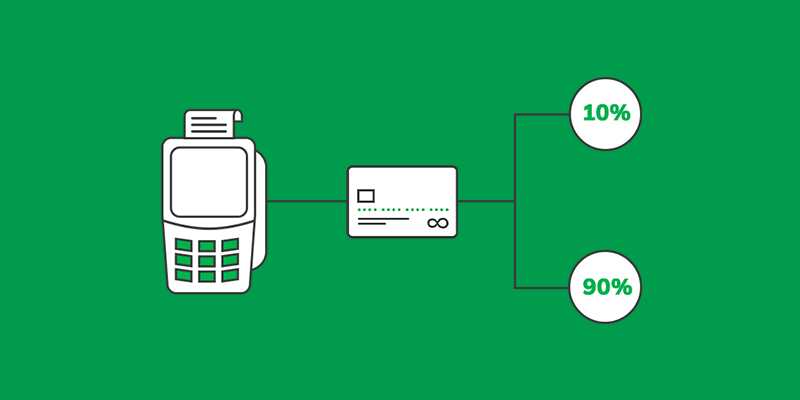

Repayment Option 1: Split Withholding Repayments

This repayment method sets a percentage of your daily credit card transactions to be automatically directed to the lender. Known as Split Withholding Repayments, it ensures that the amount you repay each day adapts to your business’s revenue flow. By tying repayment amounts to your actual daily earnings, this system harmonizes with your business’s financial cycles. If you have high credit card sales in a day, the same percentage is extracted, but due to the higher amount of sales, the percentage extracted is more. If credit card sales are low, you still pay the same percentage, but the amount you repay is lower, offering a fluid and responsive approach to debt management.

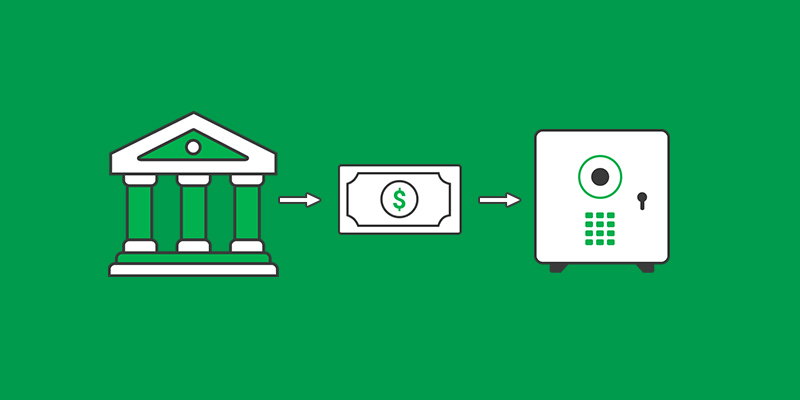

Repayment Option 2: Lock Box or Bank Account Withholding Repayments

This method introduces an intermediary step. Your sales revenue is first deposited into a designated account, from which the lender extracts their share. The remainder is then transferred to your account. It’s a bit like having a middleman temporarily overseeing your funds before they reach you, ensuring a clear separation between your sales and the repayment process.

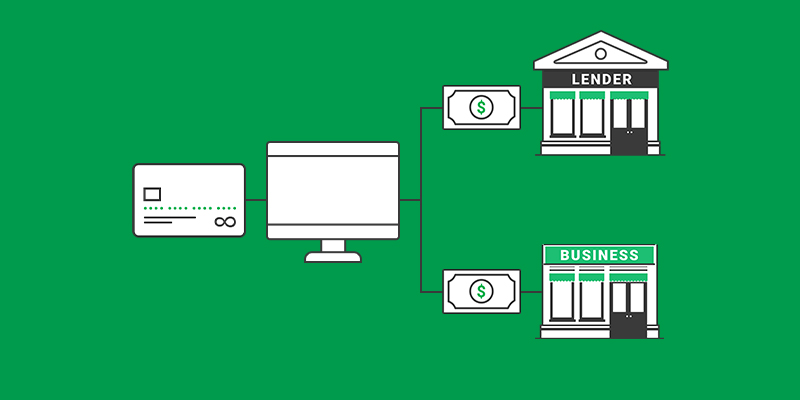

Repayment Option 3: ACH Withdrawal Repayments

This method involves Automated Clearing House (ACH) withdrawals. With ACH withdrawals, a predetermined amount is seamlessly deducted from your bank account at set intervals, similar to how you might automate your utility or subscription payments. This approach stands out for its stability and simplicity, providing a consistent repayment schedule unaffected by the ups and downs of your daily sales.

Ready to Apply?

or learn more about merchant cash advances

The Bottom Line

When you receive an MCA, you generally won’t have to worry about setting up the repayments. Your MCA provider will take care of everything for you. If they encounter any issues setting up repayments through your current merchant credit card processor, they still have options. They might opt for an ACH setup or a lockbox arrangement. In some cases, they may even ask you to switch to a different merchant processor that they can work with for the duration of the MCA. Essentially, MCA providers handle all the repayment setup details, leaving you to simply monitor the deductions to ensure there are no technical glitches that could lead to defaulting on your MCA.