When you accept a merchant cash advance (MCA), you agree to repay a fixed total amount. That amount is based on what we fund you, multiplied by a factor rate. It’s not like a loan with interest.

Be aware that repayments usually start the day after funding.

How Repayment Works

We handle the entire repayment setup. We’ll either coordinate directly with your credit card processor or we’ll pull fixed payments through your business bank account using ACH. Sometimes we’ll use a lockbox account instead.

Your role is simple. Just keep an eye on your daily deductions and your revenue. If something looks off, contact us right away. If you’re not sure what affects your pricing or total cost, you can learn more in our full guide to MCA Rates and Fees.

| Step | What Happens |

|---|---|

| 1. Accept Offer | You agree to the funding terms and repayment method. |

| 2. Sign Agreement | You sign the agreement allowing us to connect to your credit card processor or set up ACH. |

| 3. Setup Phase | We handle the technical setup of your repayment system, split withholding, ACH, or lockbox. |

| 4. Funds Disbursed | We send the full advance to your business bank account. |

| 5. Repayment Begins | Repayments usually start the next business day based on the method selected. |

The Three Main Repayment Options

There are three main ways we collect payments. The method depends on your business model and how we structure your advance.

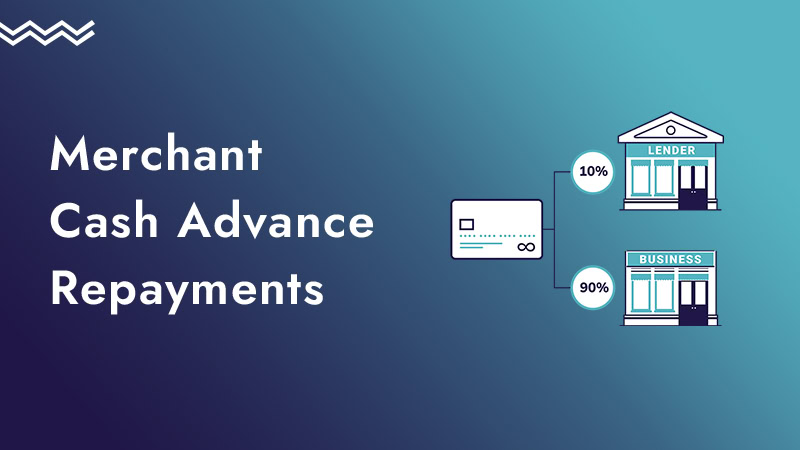

Split Withholding

If your business takes a lot of credit or debit card payments, we usually set up split withholding. We work with your processor to deduct a fixed percentage of daily card sales before the funds hit your account.

You don’t repay a fixed amount per day. Instead, the amount adjusts based on how well your business is doing. The higher your card sales, the more you repay that day. If sales are slow, the deduction is smaller.

This method works well for seasonal or variable businesses. You can read more about how MCA repayments adapt to your cash flow in our guide on MCA Benefits.

Lockbox or Bank Account Withholding

If you don’t use a card processor, or if we need more control over the payment stream, we may set up a lockbox.

With a lockbox, your sales revenue is first deposited into a special account. We take our daily share from that account, then release the rest to your business account. It’s a clear, automated system that helps prevent overpayment or shortfall.

Some business owners prefer this method because it separates operating cash from repayment. Others find it slows down access to funds. If you’re not sure which is right for you, we can walk you through it.

ACH Withdrawal

If you want predictability, or if your revenue is mostly from bank deposits (not cards), we may use ACH withdrawals.

With this method, we deduct a set amount from your business bank account each weekday. This is fixed regardless of how much you earn that day.

It’s reliable and simple. But if your revenue drops, it can create strain. If that happens, contact us early. We can often adjust the schedule or look at alternate repayment methods. Learn more about how we handle these cases in our guide on MCA Defaults.

Early Payoff and Flexibility

In most cases, you can request a payoff quote at any time. MCA fees are flat, so paying early doesn’t always reduce the total cost. Still, it can help improve your cash flow or qualify you for other funding. Learn more in our guide to Refinancing an MCA.

If revenue drops or your payment method becomes a burden, reach out to us. We’ll try to find a solution that keeps your business stable.

Problems During Repayment

Repayments are structured to match your sales, but issues can happen. You might see a failed deduction or a cash flow shortfall. Don’t wait. Contact us as soon as you notice a problem.

Repeated failures can trigger default terms, which might include legal action or collection tied to your personal guarantee. You can learn more about that in our guides to MCA Agreements and MCA Personal Guarantees.

After the Final Payment

When your balance is fully paid, we’ll confirm everything is complete. If we filed a UCC lien, we’ll release it shortly after. This ensures you’re clear to apply for new funding.

Have Questions?

If you ever need help understanding how your repayment works, we’re only too happy to walk you through it. We want you to feel confident at every stage — from funding to final payment.

Ready to Apply?

or learn more about MCA same day funding