MCA Advance

Sometimes called MCA loans or MCA funding, our small business MCA advances provide fast short-term funding in exchange for a share of future credit card sales.

Apply Online

Apply for a merchant cash advance online in less than five minutes and enjoy fast processing, no paperwork, and fast approval.

Same Day Funding

Same day funding is possible when you apply for an MCA. Receive your cash in as little as 24 hours. Our average funding time is 1-3 days.

Bad Credit Accepted

Bad credit borrowers can qualify for an MCA because the main requirements are strong credit card sales, making it easier to get an MCA even with poor credit

No Credit Check

No credit check is conducted when you apply for an MCA. Only a soft credit pull is carried out instead of a hard one to ensure your credit won’t be affected.

Merchant Cash Advance Funding to Keep Your Business Moving Forward

Our merchant cash advance funding offers fast access to the working capital you need to help ensure your business can meet its financial obligations and keep moving forward.

Our advance amounts range from $5,000 to $900,000, with automated payments and flexible repayment terms of up to 18 months and factor rates from 1.1 to 1.5.

Our MCA Rates, Terms, and Timelines

| MCA Funding Feature | MCA Funding Details |

|---|---|

| MCA Amounts: | $5,000 – $900,000 |

| Factor Rate: | 1.1 – 1.5 |

| Holdback Rate | 10 – 25% |

| Repay In: | 3 – 18 months |

| Approval Time: | Same day approvals |

| Average Funding Time: | 1 – 3 days |

Ready to get Started?

Now that you’ve seen our MCA terms, take the next step. Get a personalized advance quote based on your revenue and sales history.

Leverage Your Future Credit Card Sales to Get the Advance of Capital You Need Today

We know your business is much more than just a credit score. That’s why we assess your capital needs based on your business revenue and credit card sales. The lump sum we offer is based on the volume of credit card payments your business processes each month. This ensures you receive the right amount of capital to move your business forward, not hold it back.

What You Need to Apply

To apply for a merchant cash advance with MCashAdvance, you need to meet the following requirements:

- Monthly credit card sales of at least $7500.

- Three months of bank statements or merchant processor statements.

- A minimum credit score of 550 FICO.

- At least six months in business.

- Be at least 18 years old and a US citizen or resident.

If you meet all our criteria, click below to apply:

How to get an MCA

Apply for a merchant cash advance online through our easy-to-use online portal and complete the online application and funding process in 4 simple steps:

Step 1. Apply

Online

Click on the ‘Apply for an MCA’ button and enter basic information about your business into our online form.

Step 2. Submit Documentation

Provide the last three months of your business bank statements or credit card processing statements to verify your financial information.

Step 3. Let Us Review

Our underwriters will review your documents and application. If you’re eligible, we’ll approve your MCA and send you a funding offer.

Step 4. Receive Your MCA

Once you accept the offer and sign the contract, the lump sum payment from your MCA will be deposited directly into your bank account.

Trusted by Thousands of Small Business Owners Like You

5.0

Quick funding helped us upgrade our bakery. I highly recommend this lender!

Emma, Sweet Treats Bakery, Austin, TX

Verified Review

5.0

Fast and easy process, helped us boost our stock when needed

Tony, Urban Sports Gear, Chicago, IL

Verified Review

5.0

Great service, I was able to get the funds to expand my salon

Sarah, Glamour Hair Studio, Miami, FL

Verified Review

- Figuring Out if an MCA Is Right for Your Business

- What Is a Merchant Cash Advance?

- Common Uses for MCA Funding

- MCA Approval and Eligibility Basics

- How MCA Repayment Works

- Total Cost of MCA Financing

- MCA Funding Example and Payback Timeline

- Pros and Cons of MCA Funding

- MCA Impact on Business Cash Flow

- MCA Contract Terms and Legal Risks

- How MCAs Affect Business Credit

- Choosing a Reliable MCA Provider

- Using MCA Funding in Seasonal Businesses

- What Happens If You Default on an MCA

- Alternatives to Merchant Cash Advances

- When an MCA Makes Financial Sense

Figuring Out if an MCA Is Right for Your Business

As a direct MCA provider, we want you to choose the funding option that’s best for your business, even if you decide to fund with someone else.

This section explains how merchant cash advances work, what they cost, when they make sense, and what risks to consider.

No pressure. Just clear, honest information to help you decide if an MCA or a traditional loan is a better fit for your current situation.

What Is a Merchant Cash Advance?

A merchant cash advance (MCA) provides fast funding for short-term business needs or cash flow gaps.

It’s not a loan. Instead, we give you a lump sum of capital upfront. You repay that amount, plus a fixed fee, called a factor rate, through a percentage of your future credit card sales or total business revenue.

Because repayment is tied to your sales, it lowers our risk. That’s why many business owners qualify for an MCA, even if they’ve been denied a loan due to low credit or lack of collateral.

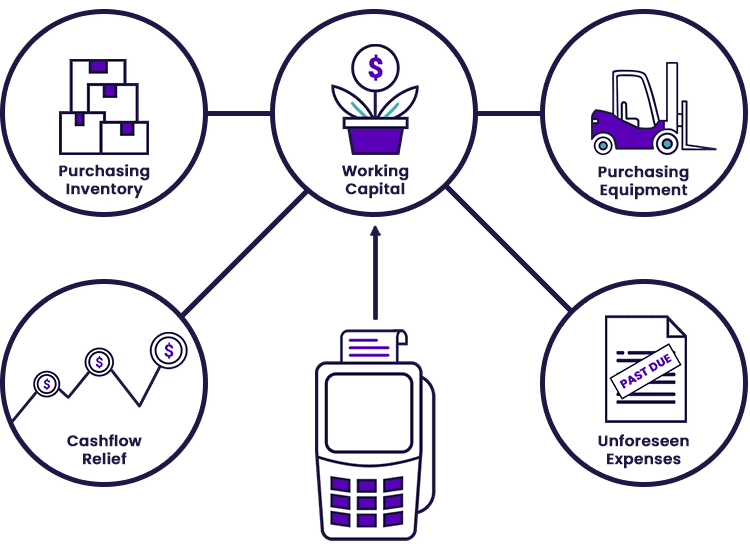

Common Uses for MCA Funding

You can use a merchant cash advance to cover almost any short-term business need. Many business owners we’ve funded have used their advance to:

- Fill cash flow gaps

- Restock inventory

- Cover payroll or vendor payments

- Fund emergency repairs

- Manage seasonal shortfalls or renovations

We don’t restrict how you use the capital. You can explore more ways real businesses use MCA funding.

MCA Approval and Eligibility Basics

We work with business owners who need fast funding and may not qualify for traditional financing.

Even if you have low credit, limited time in business, or no collateral, you may still qualify for our MCA.

To be eligible, you’ll need:

- At least $8,000 in monthly revenue

- 6 or more months in business

- A FICO score of 500 or higher

- 3 to 6 months of business bank or merchant statements

We don’t ask for a business plan or physical collateral. Approval is based on your revenue, not your credit score. Other providers may ask for more. You can see what they typically require in our MCA qualification checklist.

How MCA Repayment Works

We deduct a small percentage from your credit card sales each day. This percentage is called the holdback rate, usually between 10% and 25%. If your sales increase, the advance is repaid faster. If sales drop, it takes longer. The total repayment stays the same.

Repayment Example

Let’s say your holdback rate is 15%:

- If you make $1,000 in card sales, you repay $150

- If you make $500, you repay $75

Your repayment moves with your sales.

How We Collect Payments

There are three ways repayment can happen:

- Split withholding. We take a percentage of your daily card sales

- Lockbox. Payments go through a third-party account, and you receive the remainder

- ACH withdrawals. We pull a fixed amount from your bank account

We’ll set this up by connecting to your card processor or bank. You’ll authorize this during funding. Payments will be collected automatically, so no manual action is needed.

Important. Repayment usually starts the day after you receive your funds. Make sure you’re ready for daily deductions so your cash flow isn’t disrupted.

How Long Repayment Takes

Most advances are structured by the MCA provider to be repaid within 3 to 18 months. This depends on your funding amount, holdback rate, and daily card revenue.

You can estimate your own timeline using our MCA calculator.

Total Cost of MCA Financing

MCAs don’t use interest rates. Instead, we charge a fixed factor rate, typically between 1.1 and 1.5.

Factor Rate Example

If you receive a $20,000 advance with a 1.2 factor rate, you repay $24,000 in total.

Factor rates are fixed. Paying early won’t reduce the total cost.

Some providers charge added fees like origination or underwriting. We’re upfront about total repayment. It’s smart to review typical MCA rates and fees across providers.

APR Warning

MCA payments happen daily, and most are repaid in a few months. Because of the short term, the APR can appear very high, sometimes over 300%.

But APR doesn’t always reflect the true cost of an MCA.

The best way to assess affordability is to look at the total fixed fee and ask yourself.

Is my business comfortable paying that amount in exchange for fast, flexible access to capital?

MCA Funding Example and Payback Timeline

Let’s say your business brings in around $25,000 per month in credit card sales. You apply for a $20,000 advance. We offer a 1.2 factor rate with a 15% holdback.

This means you’ll repay $24,000 total. We collect 15% of your daily card sales, about $125 per day, until the full advance and fixed fee are paid off.

| Details | MCA Example |

|---|---|

| Advance Amount | $20,000 |

| Factor Rate | 1.2 |

| Holdback (Daily) | $125 (15% of daily card revenue) |

| Estimated Repayment Period | 6.4 months (about 192 business days) |

| Total Repayment | $24,000 |

| Estimated APR | 71.17% |

This example assumes consistent daily sales. In reality, your repayment period may vary based on daily fluctuations.

Try our MCA calculator to model your own numbers.

Pros and Cons of MCA Funding

Pros

- Fast approval and same-day funding

- No credit score or collateral required

- You choose how to use the capital

- Approval is based on your monthly revenue

You can also review the full list of MCA benefits to see how this funding could support your business.

Cons

- Higher cost than traditional business loans

- Daily or weekly deductions can affect cash flow

- Paying early doesn’t reduce the cost

- Won’t help build your credit score

You can also review the full list of MCA drawbacks to understand the risks.

MCA Impact on Business Cash Flow

MCA repayments are deducted automatically, usually daily or weekly. This reduces your available cash, especially in slower months.

Review your revenue projections to make sure your business can handle the holdback without disrupting operations.

MCA Contract Terms and Legal Risks

MCAs aren’t loans, so they aren’t covered by federal lending laws. That means your contract may include terms not found in traditional loans. Common examples include:

- Confession of judgment. Lets the provider enforce repayment without court

- UCC lien. Gives the provider a claim on your business assets

- Personal guarantee. Makes you personally responsible if the business can’t repay

Learn more about MCA personal guarantees and how they affect liability.

Always review your contract carefully. Ask questions. Consider legal advice if anything is unclear. You can also check our MCA agreement guide for a breakdown of standard clauses.

How MCAs Affect Business Credit

We only run soft credit checks, so applying won’t affect your credit score.

We don’t report on-time repayments to credit bureaus. That means MCA funding won’t help build your credit history.

However, if you default and the balance goes to collections or court, especially if you signed a personal guarantee, your credit could be negatively impacted.

Read more in our guide on MCA credit reporting.

Choosing a Reliable MCA Provider

Whether you fund with us or another provider, choose carefully.

Before accepting an MCA offer, ask:

- What is the total repayment amount?

- Are there any additional fees?

- Does the contract include a confession of judgment or personal guarantee?

- How will repayments be collected, ACH, lockbox, or split withholding?

If you have multiple offers, compare them side by side. Look at the total cost, repayment terms, and how each advance is structured.

Always choose a provider who understands your business and is transparent about every term. Avoid anyone who pressures you to sign quickly or refuses to show the full cost upfront.

Using MCA Funding in Seasonal Businesses

If your business is seasonal, an MCA can help manage revenue swings. Since repayments are tied to your sales, you pay less during off-peak months and more during busy periods.

That flexibility makes MCA funding more manageable than fixed loan payments. We often fund tourism, retail, landscaping, and other seasonal businesses ahead of their peak seasons.

What Happens If You Default on an MCA

Missing a scheduled deduction, even due to a bank error, can trigger default under many MCA agreements.

Here’s what might happen:

- Legal action

- Frozen business accounts

- Collection efforts

- Immediate judgment if you signed a confession of judgment

Read our full guide on defaulting on an MCA.

If you’re already funded with us and worried about missing a payment, reach out early. We may be able to pause deductions or adjust your schedule.

Alternatives to Merchant Cash Advances

If you qualify, there are lower-cost options to consider:

- Business line of credit. Flexible access, pay interest only on what you use

- SBA loan. Government-backed with low rates and long terms

- Invoice factoring. Get fast cash by selling unpaid invoices

- Equipment financing. Spread out the cost of major purchases

- Online term loan. Fixed payments and predictable terms

Most of these options have APRs between 8% and 25%. MCA rates can be much higher, sometimes over 300%, depending on your risk and repayment speed.

Explore more alternatives to an MCA to compare terms and qualifications.

When an MCA Makes Financial Sense

An MCA may be a good fit for your business funding needs if:

- You need working capital quickly

- You have steady credit card sales

- You’re covering a short-term need with a clear return

- You don’t qualify for lower-cost funding options

Many business owners use MCAs successfully to stay operational or act on new opportunities. Others struggle, especially after stacking or renewing advances too often.

Make sure your business can handle daily deductions. Have a clear plan to repay. Use the advance strategically while working toward lower-cost funding in the future.

We recommend MCA funding when speed matters, you can’t qualify elsewhere, and you’re willing to pay more for flexible, fast capital.

Ready to Apply for a Business or Merchant

Cash Advance Online?

If you’re ready to apply for a merchant cash advance online, click the ‘Apply for an MCA’ button to start the application process. If approved, you could get your cash advance in as little as 24 hours.

No hidden costs or fees

No paperwork

5-minute application

Bad credit accepted

No obligation to accept

High approval rates